Why do the same people who continually cry that “corporations aren’t people” want to tax them as though they were? Corporations are voluntary organizations of individuals. The law should protect the rights of each individual (including the right to speak as part of a group), not impose double burdens on individuals who happen to participate in corporations. Yet today’s tax code punishes individuals who invest in corporations twice: once at the corporate level and once at the individual level.

Why do the same people who continually cry that “corporations aren’t people” want to tax them as though they were? Corporations are voluntary organizations of individuals. The law should protect the rights of each individual (including the right to speak as part of a group), not impose double burdens on individuals who happen to participate in corporations. Yet today’s tax code punishes individuals who invest in corporations twice: once at the corporate level and once at the individual level.

Thus, far from getting off easy on his taxes, Mitt Romney suffers unjust double taxation. John Berlau and Trey Kovacs explain this important context in an article for the Wall Street Journal. They write, “Our tax code layers taxation of dividends and capital gains on top of a top corporate tax rate of 35%,” and such “double taxation brings the effective tax rate on investment income to as much as 44.75%.”

At least Romney wants to limit the corporate income tax rate to 25 percent. But he should go much further and call for the abolition of all corporate taxes with a commensurate cut in federal spending. Not only would that end this injustice of double taxation, it would protect the rights of corporations to use their resources to create wealth, profits, and employment.

Romney’s critics are right about one thing: It is grotesquely unfair to tax individuals who earn less an even greater proportion of their income. Thus, as a good first step tax rates for all individuals should be reduced to 15 percent or less. Forcing some people to hand over a third or more of their earnings to the politicians and bureaucrats of the federal government is a blatant violation of their rights.

Related:

- Romney Should Call for Property Rights and Lower Taxes for Everyone

- To Protect Rights, Phase Out Payroll Tax Completely

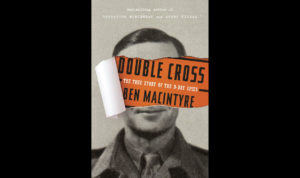

Image: Creative Commons by Brian Rawson-Ketchum via Wikipedia